Proforma invoice template

If you're freelancing or running your own business, you don't want to spend more time than necessary creating proforma invoices. Get access to our free pro forma invoice template.

Download the best proforma invoice template

To reduce time spent on invoicing, you can download the best proforma invoice templates from Invoice2go. Our templates are fully editable and can be downloaded in pdf, excel, or word format to customize and use as you require.

Benefits of using a proforma invoice template

Using a proforma invoice template carries several benefits to help you and your business. These include:

- They save time. Creating an entirely new document every time you send a proforma invoice is time-consuming. Simply filling in a template each time gives you more time to concentrate on running your business.

- Accuracy. By just filling out the details of the particular proforma invoice, you can concentrate on the essential information, making it much less likely that there will be mistakes.

- Professionalism. Sending out documents that have a consistent look and format looks professional to your customers and clients, helping to build trust in your relationships.

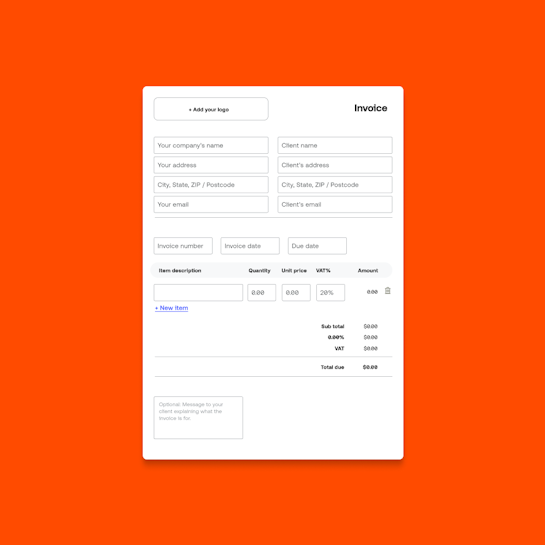

Free invoice generator

To make things even easier, at Invoice2go, we have a simple online invoice generator. Simply fill in the online form with your company details and the full details of what you wish to invoice, and upload your company logo, and it’s ready to go. You can download it as a pdf or email it directly to your customer through our website.

How do I edit a proforma invoice template?

Editing a proforma invoice template is straightforward. Once you have selected the proforma invoice template on the Invoice2go website, follow these steps:

- Open the template in whichever format you choose—pdf, excel, or word document.

- Customize the headers and add your company logo and contact information.

- Fill out each line with descriptions, quantities, and prices.

- Add tax and shipping details if required.

- Send to your customer by email or post as required. Remember to save in a non-editable format such as a pdf if you are sending it electronically.

What are proforma invoices used for?

If you supply goods or services to an individual or business and need payment in advance, you need to use a proforma invoice. This usually happens for two main reasons. Firstly, if you are dealing with a client for the first time, it is common to ask for payment upfront. Advance payments can help build a trusting relationship with the client, and they may be offered an account with, for example, 30-day invoicing on further orders.

Secondly, you may have done a credit check on your customer and found that their credit rating is terrible. In this case, it’s best to use pro forma invoicing on an ongoing basis, at least until their credit rating shows sufficient improvement.

Proforma invoice frequently asked questions

What is a proforma invoice?

What is a proforma invoice?

A proforma invoice is a request for payment for goods or services sent in advance of those goods or services being supplied. Usually, the invoice must be paid before any work is undertaken. Proforma invoices are typically sent if there is an issue with a customer’s creditworthiness or if it is their first order with your business. Many businesses have a policy that first orders must be on a proforma basis to avoid being scammed.

Sometimes it is also prudent to use a partial proforma. For example, you may want to invoice for 50% of the order value before work begins and the remaining 50% upon completion of the order or project.

How do I create a proforma invoice?

How do I create a proforma invoice?

You can create a proforma invoice in a variety of ways. You can write it in Word or Google Docs or build one as a spreadsheet in Excel. Or, of course, you can simply download one of our templates from the Invoice2go website. When creating one, you should always include the following details:

- Your company name, address, and contact details

- Your company logo

- The client/customer’s company name, address, and contact details

- Shipping address if applicable

- Lines detailing each item, including descriptions, quantities, and prices

- Tax and shipping prices and details where applicable

- Total price

You should also include details of how and where to pay and any terms and conditions. For example, you should outline if the invoice needs to be paid wholly or partly before goods or services are rendered. You may also want to include at what point your customer gains ownership of goods and the Incoterms details.

What is the best format for a proforma invoice?

What is the best format for a proforma invoice?

The best format for your proforma invoice templates depends on how you use them and how complex your invoicing needs are. For example, if most of your proforma invoices are very simple, with one or two lines, you may want just to print off a pdf template and fill it in by hand, especially if you have an employee that is not very tech-savvy.

On the other hand, if your proforma invoices involve multiple lines with large quantities, an Excel spreadsheet format might be best, as it can do all the calculations for you and easily print across multiple sheets. If your business needs are somewhere in the middle, any calculations are not hard to do, and you are comfortable with Word, then that is the format for you.

Whichever format you require, be it pdf, Word, or Excel, Invoice2go can meet your needs with our easily editable and customizable proforma invoice templates, downloadable direct from our website.

What is the difference between a proforma invoice and an invoice?

What is the difference between a proforma invoice and an invoice?

The essential difference between a proforma invoice and an invoice is when payment is expected. A proforma invoice is sent if payment is required either partially or in full in advance, whereas an invoice is sent after the delivery of goods or services has been completed. A standard invoice will usually be written with clear terms of payment included; if payment is expected immediately, after 7 days, 30 days, or at the end of the calendar month, for example.