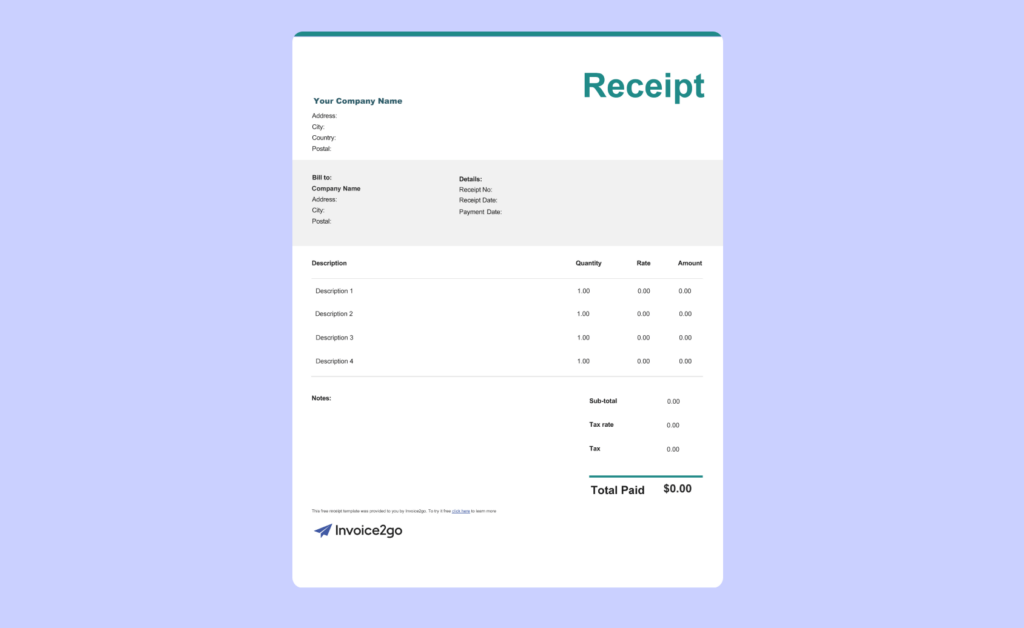

Sales Receipt Template

Keep track of payments with a sales receipt. Our free sales receipt templates offer clean layouts, content blocks, and essential information for your records.

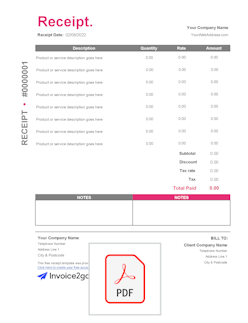

Download a sales receipt template

Get started by downloading the best sales receipt template from Invoice2go. These receipt templates make it quick and easy to reach your clients.

What is a sales receipt?

A sales receipt is a transaction record that you give your customer after they pay for your services. You fill out the sales receipt, then send it to your customer through email or paper mail. This confirms that you received the payment and gives the customer a document for their records. You’ll also keep a copy of the sales receipt for your own records.

Benefits of using a sales receipt template

A sales receipt template keeps track of transactions in a neat, orderly format. Each document has information about the transaction, including the date and payment amount. Keep the receipt in your file, then refer back to it during tax season or a customer dispute. Sending a receipt also shows professionalism on your part, inspiring the customer to hire you again.

How do you edit a sales receipt template?

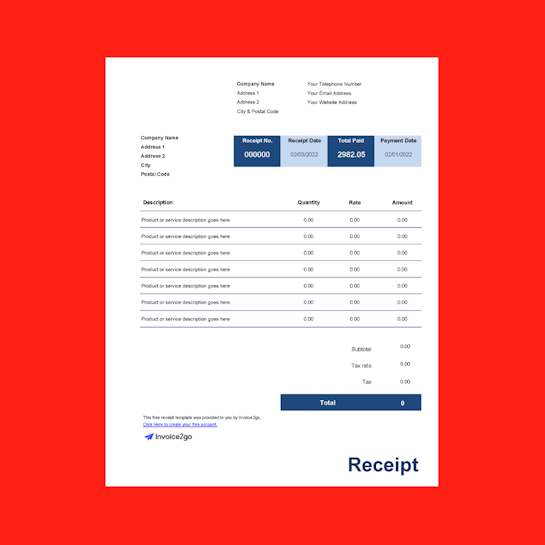

To edit a sales receipt template, download one of the templates below, then open the document in a word processing program. Save a clean copy so you don’t have to re-download the receipt template every time. Afterward, copy the file and give it a descriptive file name so it doesn’t get lost among the rest of your receipts.

Click on each text box to customize your sales receipt template, change the logo, colors, and layout. Update everything on the receipt, including the date, balance, and receipt number–your program may not update this information automatically. If you have multiple purchases on the receipt, add or remove rows as necessary.

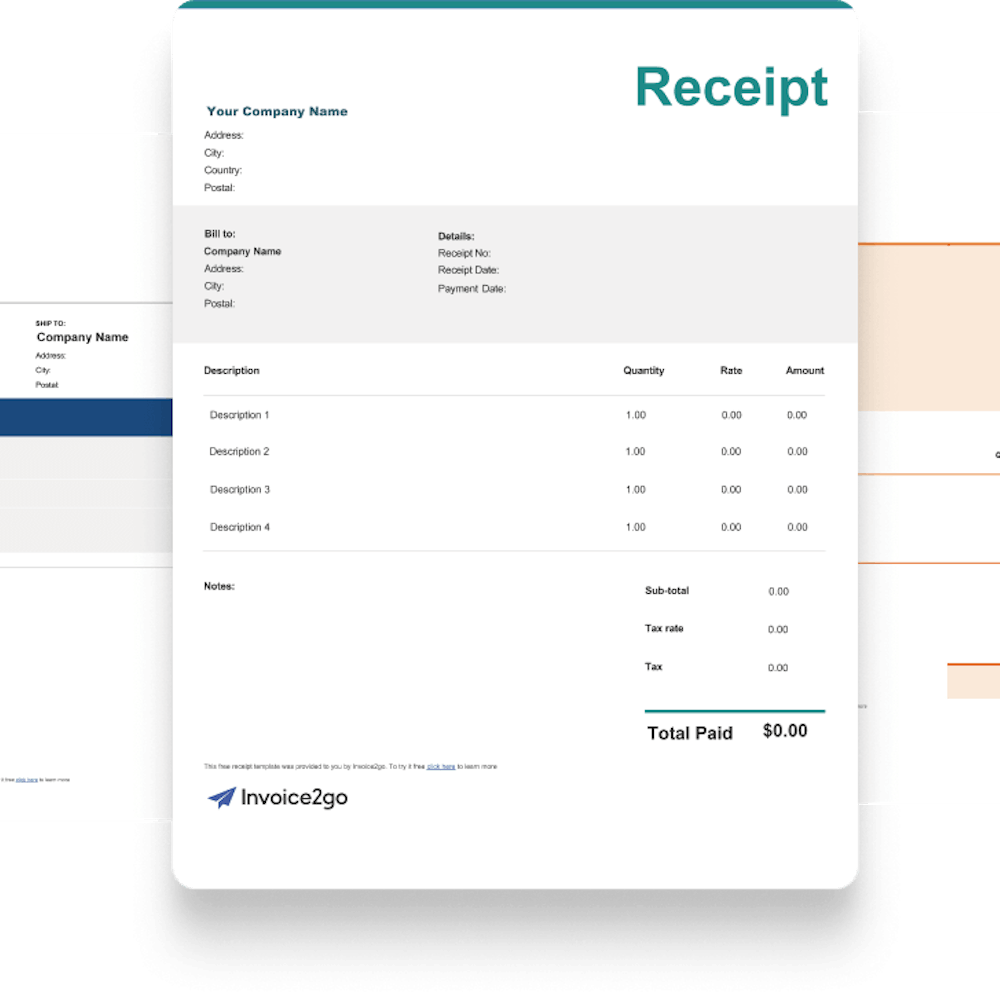

What information is on a sales receipt?

Your sales receipt may include the following information:

- Company logo

- Your personal or company address

- Customer’s name and address

- Receipt number

- Date that you received the payment

- List of purchases with prices

- Sales tax

- Total balance paid

- Payment method

- Notes about the transaction

The layout is nearly as important as the information itself. Would you hire a business again if their “receipt” was an email with just the date and price? Your sales receipts should have clean, professional layouts that immediately show customers what they need to know. Use tables, branding, and neat content blocks to show your clients that you value their business.

Sales Receipt Frequently Asked Questions

How do I make a sales receipt?

How do I make a sales receipt?

To make a receipt, start by keeping a record of each client. Use a spreadsheet to track each customer’s name, billing address, current balance, and the goods sold or services rendered. Date each service so you don’t accidentally charge customers for the same service twice. Don’t delete old transactions–you might need to refer back to them later.

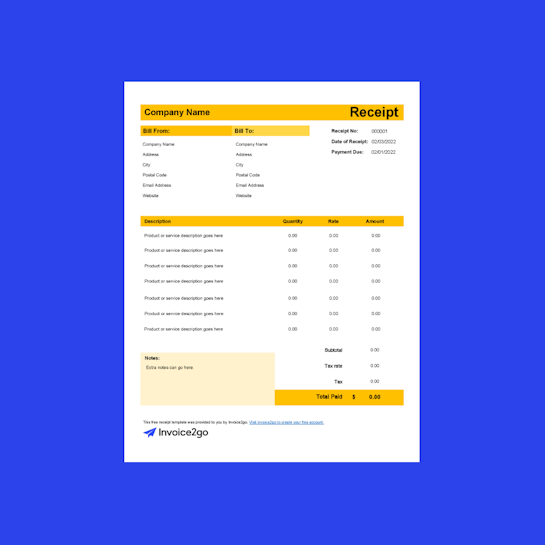

When you receive your payment, refer back to this record to make your receipt. Download a free sales receipt template from Invoice2go, then adjust the colors and branding and fill out the information. List every payment even if it’s small. Even if your customer only paid a few dollars, you both need to know where that money went.

When do I use a sales receipt?

When do I use a sales receipt?

You’ll use a sales receipt every time a customer makes a payment. If they’re paying in one lump sum, you can prepare the receipt ahead of time and send it right away. To make it easier, use Invoice2go to track your customers’ payments directly through the platform. Invoice2go tracks each installment and gives your customers multiple payment options, including cash, check, PayPal and credit card. You’ll also set up invoices and submit them directly with the software.

Sales receipts are particularly valuable if your customer pays in cash. Since cash doesn’t have a digital record, they can’t prove that they bought your service otherwise. Depositing it in your bank account won’t help you because it doesn’t record where you received the money. If you’re not in front of a computer, make two copies of a paper receipt and add your copy to your records.

What are the benefits of providing a sales receipt?

What are the benefits of providing a sales receipt?

A sales receipt provides a payment record for both you and your customer. When your customer reviews their expenses, makes a budget, or needs to reorder your services, they’ll check the sales receipt. The receipt has everything they need to know about the payment, including a list of services with prices, the date of the payment, and the billing address.

If your customer pays in installments instead of a single sum, receipts help them keep track of each payment. Your receipt also lists the current balance so they know how much they still owe you. This reduces the likelihood of missed payments, duplicate payments, and disputes about how much they paid.

On your end, the receipt provides a record of each transaction. If the customer doesn’t pay the entire bill, you’ll see how much they still owe–and send a reminder if necessary. Keep receipts for tax season so you can accurately report your income. You’ll also check receipts when you track your monthly profits and expenses.

Receipts also send the message that you’re an experienced business owner. If you don’t send a receipt, customers wonder if you keep track of payments, making them more likely to dispute the balance. Building receipts shows clients that you track every payment, service, and client to keep your expenses in order. Your expertise impresses them, turning them into a repeat customer.

If you allow exchanges or returns, a receipt provides proof of purchase so customers can request their return. Think of it like shopping at the grocery store: they won’t refund your item if you can’t prove that you bought it in the first place. This provides added convenience because you won’t have to dig through your payment history.