Contractor Receipt Template

Getting the paperwork right protects contractors and clients alike, so ensuring that everything is right on your contractor receipts is vital.

Download a contractor receipt template

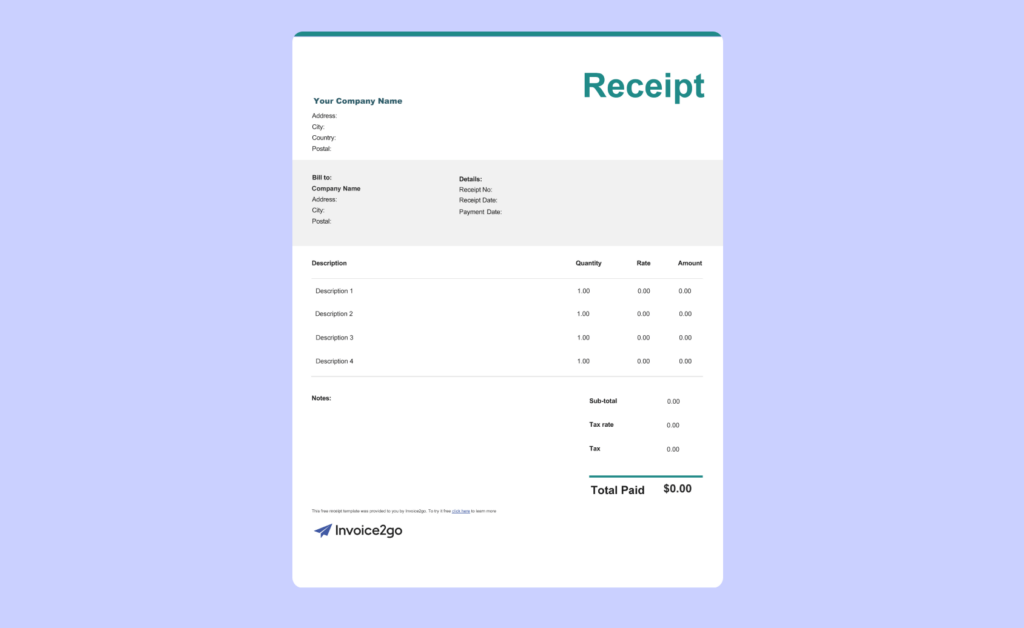

If you want to reduce time spent on admin, you can download the best contractor receipt templates from Invoice2go. We have a great choice of fully editable templates that are available in pdf, excel, or word format. Simply download, customize and use as needed.

What is a contractor receipt template?

A contractor receipt template is a base document that includes the information you want to have on every contractor receipt you issue. Contractor receipts detail all of the services that a contractor has performed and how much they charged and are proof that these services have been completed and paid for.

Benefits of using a contractor receipt template

Using a contractor receipt template has many benefits for your business, including:

- They save time, avoiding the need to create a new document every time you send a contractor receipt.

- Improve accuracy by concentrating on the essential information.

- They look professional. Documents with a consistent look and format look more professional to your customers and clients.

How to edit a contractor receipt template

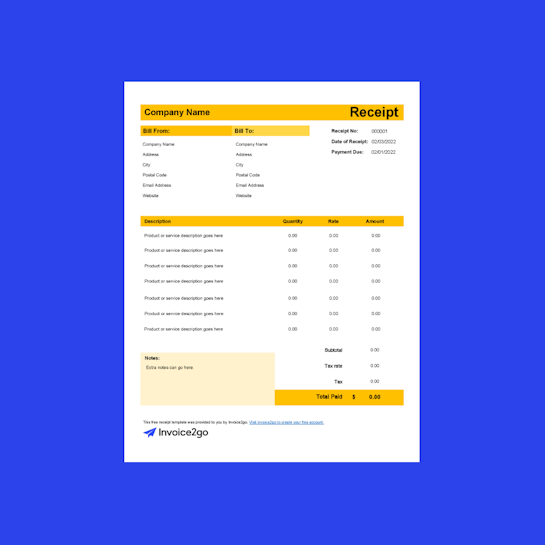

Editing one of Invoice2go’s contractor receipt templates is an easy process. Simply select the proforma invoice template on the Invoice2go website and follow these steps:

- Download the template in your preferred format—pdf, excel, or word document.

- Open the file, then add your company logo and contact information to customize the header.

- Add descriptions, quantities, and prices to lines as required.

- If needed, add tax and shipping details.

- Save in a non-editable format such as a pdf if you are sending it electronically.

- Either print off and post or email it as an attachment.

What information is on a contractor receipt?

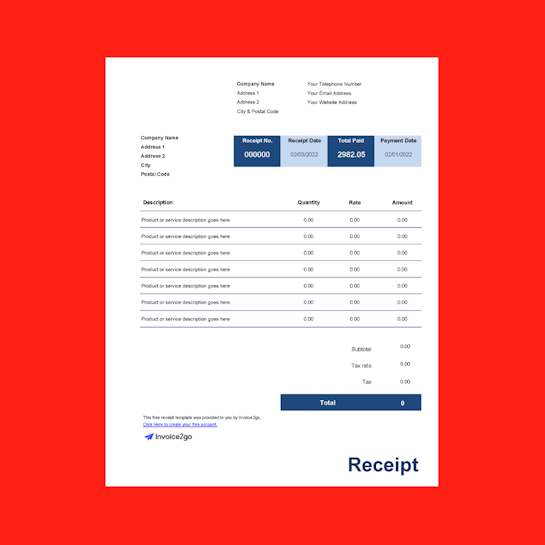

As with any other commercial document detailing a financial transaction, there are some basic details that you need to include on every contractor receipt. These are:

- Date the receipt was issued

- Name, address, and contact details of the contractor

- Name, address and contact details of the client

- Complete details of goods and services provided, including descriptions, quantities, and prices

- The date that goods and services were provided

- Any taxes included

- Labor costs, materials, and total cost

Additional details that you might need in a “notes” section could include contractual information such as warranty periods or service agreements.

Contractor Receipt Frequently Asked Questions

How do I make a contractor receipt?

How do I make a contractor receipt?

Depending on your preference, you can write a service invoice using software packages such as Excel, Word, Adobe PDF, or Google Sheets. It’s essential to include enough information for the client to know precisely what they are paying for.

However, don’t go into too much unnecessary detail, as this could result in a document that’s hard to understand. Should you need to include complete technical or contractual information, this can be referenced within the receipt and sent as separate documents.

You can produce your contractor receipts by writing a new document for every job, but why go through a needlessly time-consuming and unnecessary process? Instead, you can make your life easier by downloading Invoice2go’s easy-to-use service invoice templates.

Take a look at all of the other free receipt templates we have to offer. If you are looking for contractor invoice templates, we also have those available.

What are the benefits of providing a contractor receipt?

What are the benefits of providing a contractor receipt?

Providing a contractor receipt gives clarity for the client and contractor. This is a net benefit as it keeps both parties on the same page, each knowing what to expect. It’s also a helpful document should the client wish to enquire about the same or similar services again at a later date.

Another benefit that you shouldn’t underestimate is providing a professional look to customers. For example, a contractor that doesn’t offer contractor receipts might not be seen as a reputable and trustworthy business to deal with; contractors who don’t want a paper trail may be attempting to avoid scrutiny in the event of a dispute.

Why are contractor receipts important?

Why are contractor receipts important?

Ensure your construction project runs more smoothly. Contractor receipts are vital for both parties to keep their financial records up-to-date. They are certainly something that IRS auditors will want to see, and your accountant will be much happier if they can see complete records that include contractor receipts.

Another critical use of contractor receipts comes to the fore in the event of a dispute after the job is complete. Should a client be unhappy and claim that work was not done, receipts showing exactly what they were billed for will be very useful in court. Conversely, if there is no receipt, this makes it very hard to decide a case and may cause it to drag on with extra legal fees.

Should contractors provide receipts?

Should contractors provide receipts?

The simple answer to this is yes; contractors should always provide receipts. For the reasons outlined above, contractors and their clients are in a much better position to present their points of view should a dispute arise, and have all the necessary documents organized for accounting purposes.

Of course, the contractor receipt needs to be clear and contain all necessary information. This is much easier if you are working from a professional contractor invoicing software that takes care of invoices and receipts like Invoice2go.