Payment Receipt Template

Payment receipts keep the record straight by confirming that your customer paid for their order. Make a receipt for you and the client for maximum accountability. Easily stay on top of cash payments – and all types of payments.

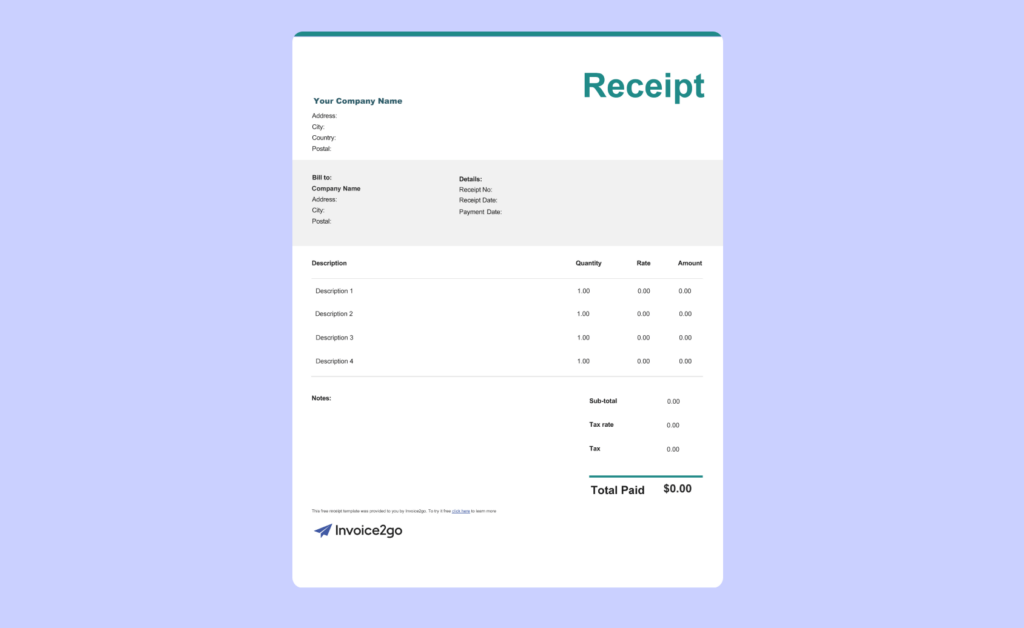

Download a payment receipt templates

Confirm payments in minutes with the best receipt template. Invoice2go offers a free receipt template with all the information your business needs. Our designs are suitable for both digital and hard copy receipts so you can complete transactions anywhere.

What is a payment receipt?

A payment receipt is a transaction record that you give customers after they pay for your services. Unlike an invoice, which lists every purchase individually, the payment receipt lists the overall price without specifications. A payment receipt also records basic information like the customer’s address. Both parties keep a copy of the receipt.

What are the benefits of using a receipt template?

Instead of staring at a blank Excel or Word document, get a head start with a receipt template. Invoice2go templates provide a clean layout with even content blocks and pre-written text. All you have to do is edit the template to reflect the transaction. The Invoice2go payment template and cash receipt template are 100% free to everyone even if you don’t invest in our software.

How do you edit a payment receipt template?

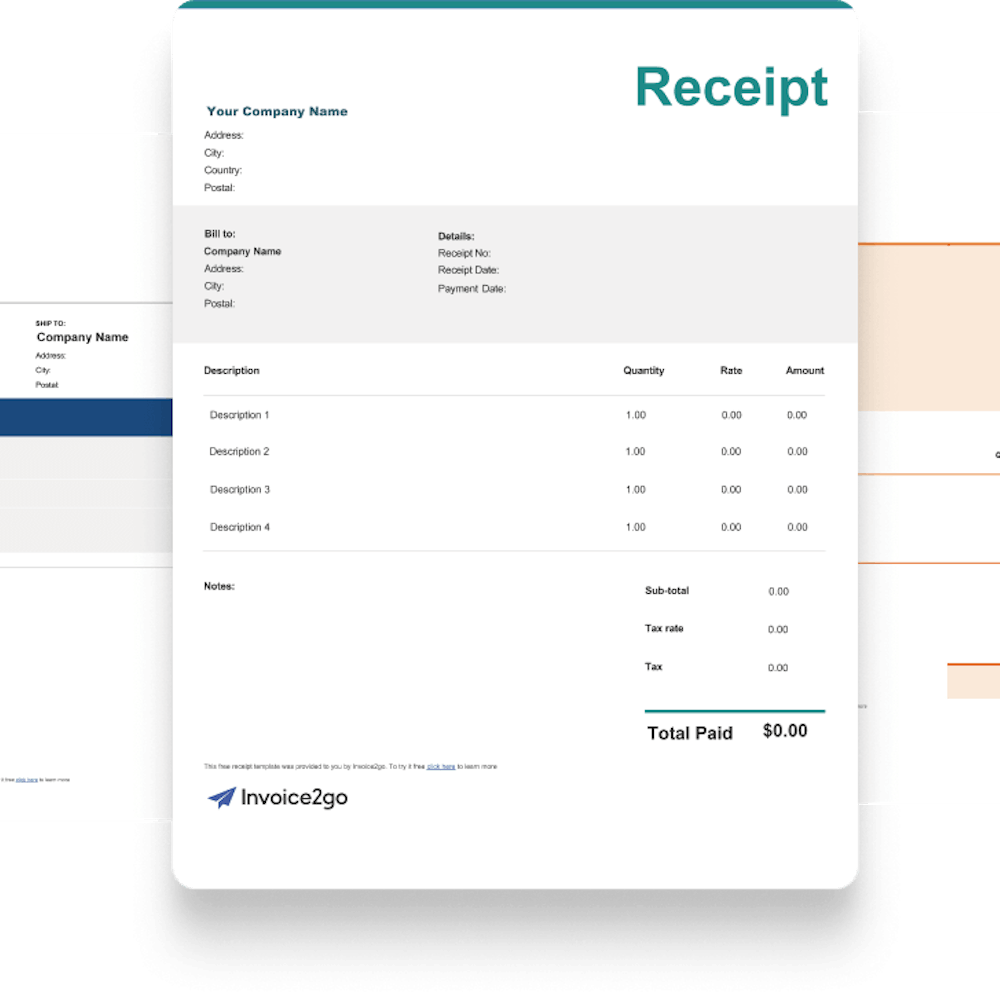

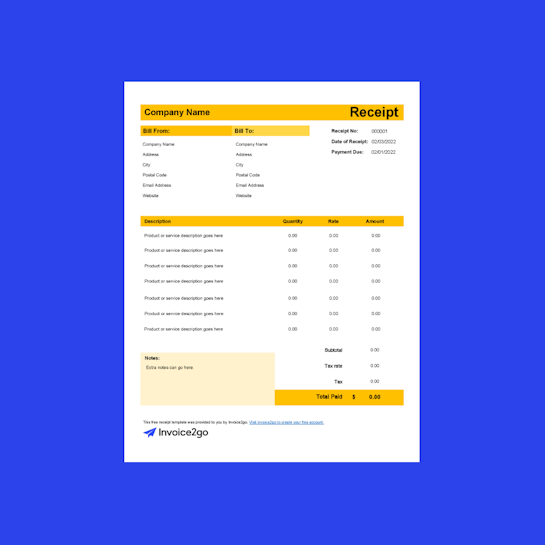

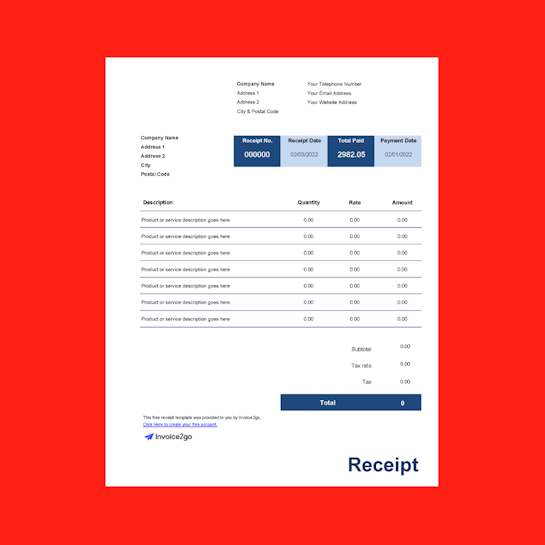

To edit your receipt template, download one of the templates below. Open your template in a program like Microsoft Word, and click on the text to edit each section. Add the date, payment method, amount, receipt number, and other important information. Make sure you record the date of payment, not today’s date.

For consistent branding, adjust the colors, graphics, and logo on the receipt. You can also stick with a basic receipt to keep it clean and professional. After you’ve made basic alterations that apply to every receipt, duplicate the file so you can use the clean copy later. Otherwise, you’ll have to re-download the template.

What information is on a payment receipt?

Payment receipts resemble checks with basic information that you can scan at a glance. A professional receipt contains the customer’s name and address, your business’s name, a brief description of services, the receipt number, the amount, the payment method, and the date the customer paid the bill.

If the customer doesn’t pay the entire bill at once, the receipt displays the amount they paid and the remaining balance. Mark “Payment Receipt” or “Cash Receipt” at the top so you and the customer can easily find it in your records. The customer may sign the receipt as confirmation that they received it.

Payment Receipt Frequently Asked Questions

How do I make a payment receipt?

How do I make a payment receipt?

To make your receipt, start by tracking the payment details. Record the exact dollar amount, the date that you received the payment, and the payment method: cash, check, bank card, or online platform like PayPal. Keep this information in an Excel spreadsheet, so you have everything in one place.

Next, download a free receipt template from Invoice2go. Add your business information, and transfer the payment details to the template. If you’re making a hard copy, write the details on the sheet. Email the receipt to the customer, or give them their paper copy. Note that you issued a receipt in your records.

What are the benefits of providing a payment receipt?

What are the benefits of providing a payment receipt?

A payment receipt provides a transaction record, reducing the risk of disputes. If a customer questions the transaction, pull the receipt out of your files to show them the amount, payment date, current balance, and confirmation that the transaction took place. Likewise, a lack of a sales receipt suggests that the customer never paid their balance.

A receipt helps your customer keep track of their progress for installment payments. Each receipt confirms the payment and states their current balance to know how much they owe you. With a clear payment record, you’ll minimize the risk of a customer paying twice or sending the wrong amount. The client uses these receipts to track their expenses and plan a budget at the end of the month.

On your end, you’ll use receipts to record your profits and ensure that your customers’ payments are up to date. Use these receipts during tax season so you report the full amount. Never throw away old receipts–a customer could dispute a charge months or years after the transaction. You might also need these receipts to show proof of income when you take out a loan or buy a house. Consider using a receipt template to simplify receipt creation.

When do I send a payment receipt?

When do I send a payment receipt?

You’ll send a payment receipt shortly after the customer pays their bill. If you complete a transaction in person, you’ll write the receipt immediately and give it to the customer. Use a carbon copy pad to make two copies instantly. Without a receipt, you won’t be able to prove that an in-person transaction took place, especially with cash payments. Consider creating a cash receipt template to simplify this process.

For online payments, make the receipt and email it to the customer as soon as possible. Don’t wait to send one receipt at the end if you’re accepting installment payments. Instead, send your customer a receipt after each payment, so they track their payments and current balance. Keep your own digital copy so you can refer back to it.

If possible, make your receipt on the same day you receive the payment. Otherwise, you might forget the payment date and create inaccuracies in your records.