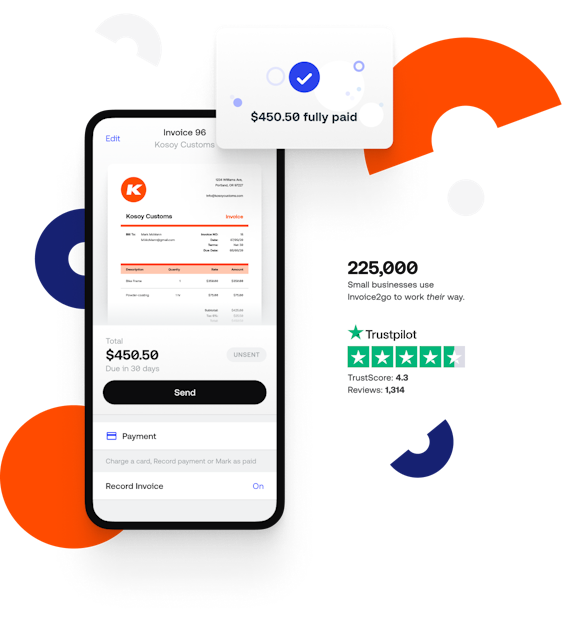

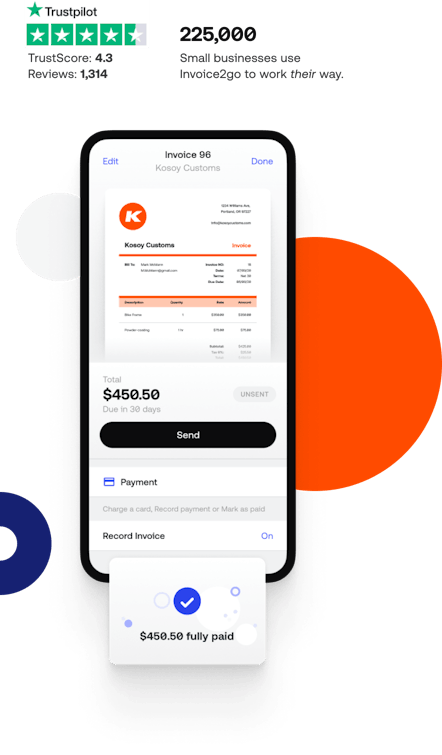

Invoice with ease

Invoice2go is your go-to tool that helps you send invoices and get paid quickly. Optimize your cashflow with easy invoicing, multiple payment options, expense management, and much more.

or continue with:

Featured In

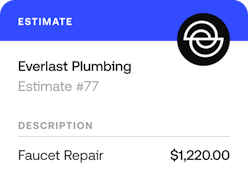

Win more work

Win 2x more work with professional-looking estimates and Invoice2go’s easy-to-use customer communication tool.

Send invoices in seconds

Save 10+ hours of work a week with Invoice2go invoice creation and customization tools, automated overdue invoice reminders, and invoice status tracking.

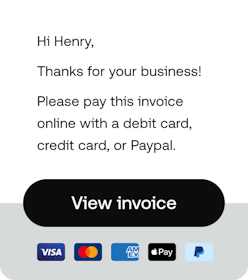

Get paid faster

Offer your customers flexible ways to pay – accept payments via bank transfer, credit card, debit card, or PayPal – and get paid 3 weeks faster. Invoice2go’s low fees let you keep more of what you earn.

Keep your business organized

Handle all your admin work in minutes

Use Invoice2go’s easy-to-use tools to attach expenses, schedule appointments, and track & bill hours.

See the big picture with business reports

Track how your business is doing and get critical insights with easy-to-use charts and graphs.

Spend less time managing your books

Sync all of your invoicing and payments data to QuickBooks or Xero for your tax preparer.

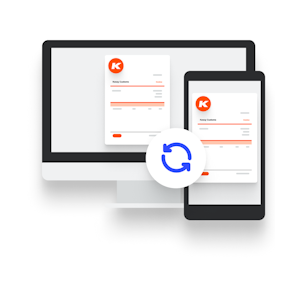

Take care of business on the spot

With the Invoice2go app (available on the web, iOS, and Android) all of your information is synced across your devices.

Level up with premium features

Recurring invoices

Automatically charge your customers for goods or services at regular intervals.

Phone support

Receive dedicated support from Invoice2go experts.

Get more done with integrations