Invoicing software for consultants

Simplify running your business and achieve more. Try our easy-to-use invoicing software for consultants. Invoice2go, a Bill.com company, can help consulting companies streamline their billing and invoicing processes.

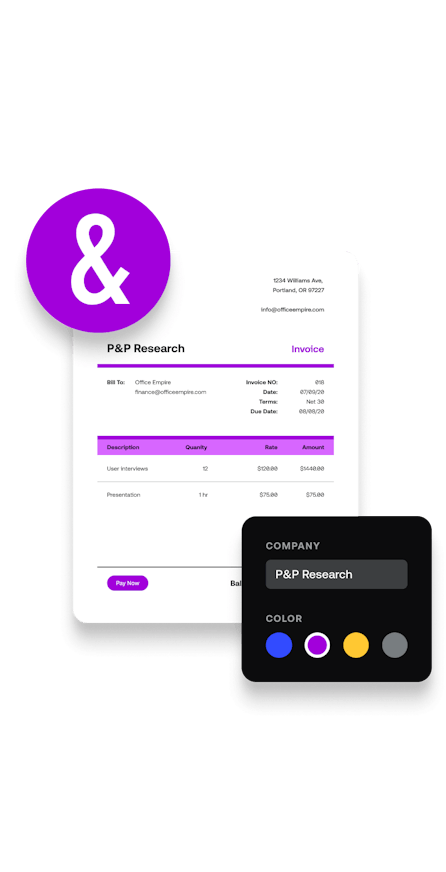

Create professional consulting invoices

Easily create professional invoices for your consulting business with just a few clicks. You can create your own customized consulting invoice template by simply adding your logo, branding, and color palette.

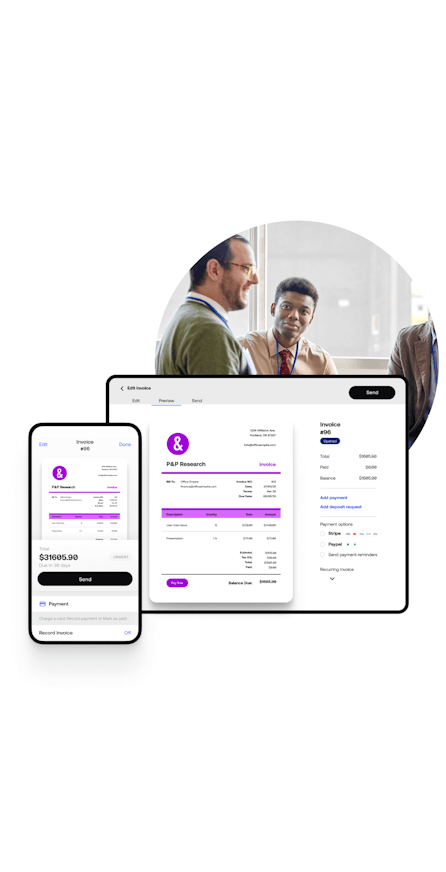

Invoice anytime from any device

Create and send invoices conveniently anywhere – whether you’re working from an office, coffee shop, or your home. Send invoices to your clients from your laptop, tablet, or cellphone.

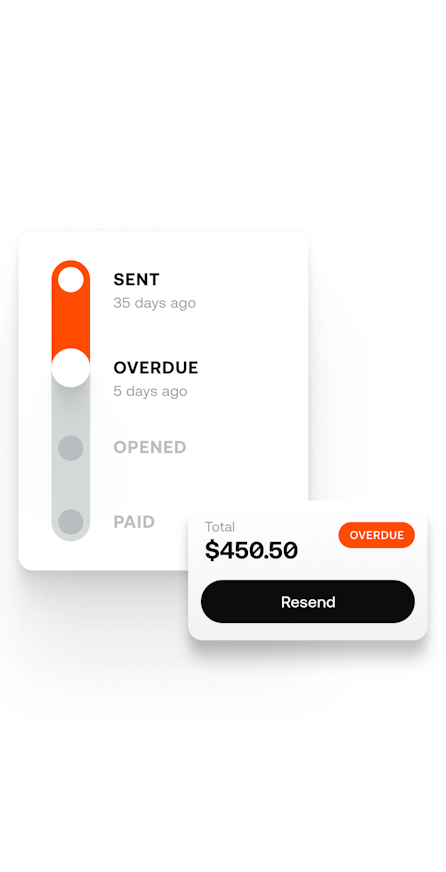

Invoice management – stay on top of invoices effortlessly

Automatically track invoice statuses and get notified when payments are made. Set up automatic payment reminders so you can stop chasing unpaid invoices.

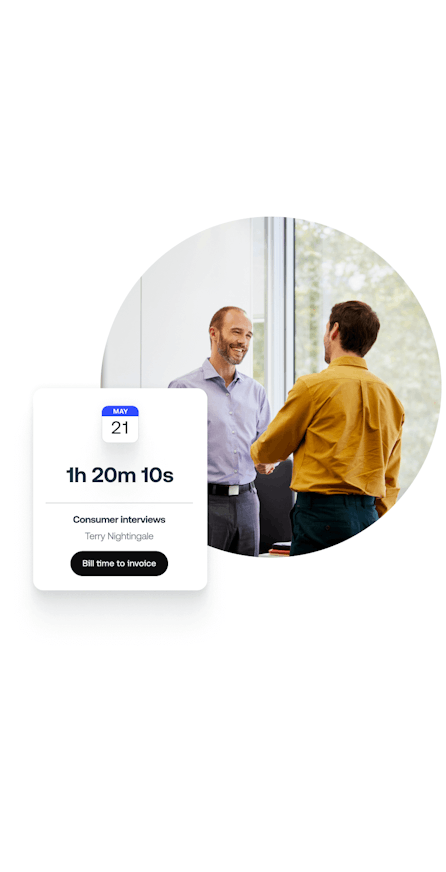

Quickly convert time tracking to invoices

Bill accurately for your hourly work. Simply hit start and end on our time tracker during a work session. Then, select time entries by client name from the time tracker and convert them into invoices.

Pro features for consultants

Schedule meetings and appointments

Easily schedule appointments and bill meeting hours by adding them to an invoice.

Manage projects and clients

Set up client profiles and keep project documents and details, billable hours, and invoice statuses organized in one place.

Accept payments in multiple ways

Offer clients’ convenience of multiple payment methods to get paid faster. Accept online payments via credit cards, PayPal, and debit cards.

5 invoicing tips for consulting services

Here are 5 invoicing tips for consultants that will help improve your invoicing process and help you get paid faster.

- Request deposits. Independent consultants only get paid upon invoice submission and not at regular intervals like an employee, making maintaining steady cash flow challenging. It’s good to request 25%-50% deposits upfront for projects that will take at least a month to complete.

- Track billable hours automatically. Many administrative tasks require the attention of a small business owner. Try to automate these tasks to lighten the load. Instead of watching the clock and taking notes of billable hours, use a time tracker to focus on your more important work.

- Invoice for projects immediately. To steadily maintain positive cash flow, it’s a good idea to submit your invoices directly after completing a project to ensure you get paid as soon as possible.

- Set clear payment terms. Remember to set clear payment terms on your invoice to avoid late invoice payments. These are standard payment terms:

- Net 7 – Payment seven days after the invoice date.

- Net 10 – Payment ten days after the invoice date.

- Net 30 – Payment 30 days after the invoice date.

- Net 60 – Payment 60 days after the invoice date.

- Net 90 – Payment 90 days after the invoice date

- Accept multiple payment methods. The more payment methods you offer, the more convenient it is for your clients to pay.

Everything you need to know about consulting invoices

What are some consultant invoicing challenges?

What are some consultant invoicing challenges?

Manual invoice processing and tracking can become overwhelming without an invoice management tool. Here are some of the challenges small business owners, consultants, and freelancers encounter when processing invoices manually:

- Errors from manual entries

- Upkeeping cashflow due to invoice process time delays

- Chasing late or outstanding payments

- Time-consuming

You can resolve all these challenges by automating your invoicing process with an invoicing tool like Invoice2go.

How do I invoice for consulting services?

How do I invoice for consulting services?

There are multiple ways to invoice for consulting services based on the type of consulting project you are working on.

- Small standalone projects. These small projects usually take less than two weeks to complete. It is best to invoice immediately after you complete the project.

- Large standalone projects. Larger projects usually take more than a month to complete. It is best to invoice and request an upfront deposit and then invoice the remaining balance once the project is complete.

- Recurring contracts and retainers. These contracts are usually hourly-based. It’s best to invoice the client monthly on a specified date.

What should you include in a consulting invoice?

What should you include in a consulting invoice?

Consultants need to submit invoices to their clients for the work they’ve done to collect payment. Here are the details that you should include on your consulting invoice:

- Professional invoice header with business logo

- Business information – address, phone number, tax number, email address

- Client information – name, phone number, email address

- Invoice date

- Invoice number

- Payment terms

- Consulting billable hours or project service details

- Sales tax, if applicable

- Invoice total

- Payment methods

- Thank you note

How do I create an invoice for consulting services?

How do I create an invoice for consulting services?

The simplest way to create an invoice for consulting services is to use a free consulting invoice template. Edit the following information to make your own consultant invoice template:

- Business logo

- Business information – address, phone number, business tax number

- Client information – name, phone number, and address

- Consulting service details

- Price or billable hours of each service

- Invoice total

- Payment due date

Here is a free consultant invoice template to help you get started.