Rent Receipt Template

Create a paper trail with Invoice2go rent receipt templates that provide transaction records for you and your tenants. Manage your finances, and reduce disputes.

Download a rent receipt template

As a landlord or property manager, keep your tenants up to date with a rent receipt. Invoice2go rent receipt templates provide a blank slate for you to alter digitally or fill out as a hard copy.

What is a rent receipt?

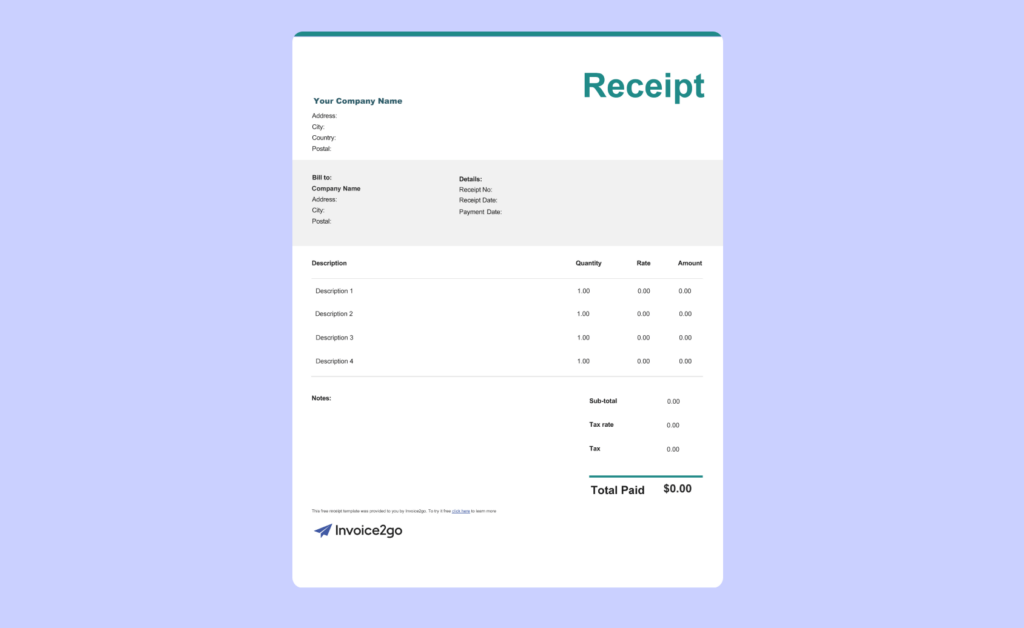

A rent receipt confirms that the tenant made a rent payment – providing a record for both parties. Some states require landlords to provide receipts at the tenants’ request. The receipt offers information like the payment date, balance due, rental period, rental property address, and name of the tenant. Make receipts to keep track of your finances and file your taxes at the end of the year.

What are the benefits of using a rent receipt template?

A rent receipt template has everything you need for an accurate record. If you make a receipt without a template, you could accidentally leave off vital information, like the payment method or remaining balance. Your tenant could dispute the charges if you don’t record everything. A template also saves work hours by providing the layout and blank form.

How do you edit a rent receipt template?

Start by downloading a free rent receipt template from Invoice2go. Open the file in a program like Microsoft Word, then edit the basic information that’s true for every receipt, like your name and billing address. Afterward, duplicate this file so you can use it repeatedly without downloading a new template every time.

Click on the text to add information or make alterations. If you itemize the services, use the table function to add or remove rows as necessary. Some programs require you to manually calculate the total, while others perform calculations for you. For added professionalism, change colors and graphics to reflect your branding.

What information is on a rent receipt?

Every rent receipt has basic information like your name, the tenant’s name, the payment date, and the amount you received. Depending on your tenant’s request, you might provide the overall cost or itemize everything, including rent, like utilities and trash pickup. Additional information could include the payment method, receipt number, and your signature.

Ask the tenant to review the receipt to confirm the accuracy. If the tenant pays in installments, include the remaining balance on the receipt, so they don’t accidentally overpay or underpay you. Keep these receipts, and follow up with the tenant if they don’t meet their deadlines.

Rent Receipt Frequently Asked Questions

How do I make a receipt for rent?

How do I make a receipt for rent?

To make a rental receipt, get started as soon as possible to reduce the risk of errors, like the wrong payment date. If you’re writing receipts by hand, use carbon paper to make a copy for both you and the tenant. Never let your tenant walk away without a receipt if they pay with cash–otherwise, you’ll have no proof that this transaction occurred.

If you prefer digital rent receipts, open the template, fill out the information and save the file. Email the receipt to your tenant, then keep the receipt on your hard drive. Print out a hard copy for extra security. Make sure you include your business information on the receipt, even if you’re just making it for yourself. This confirms your tenant made a direct rental payment.

What are the benefits of providing a rent receipt?

What are the benefits of providing a rent receipt?

For you, writing receipts helps you keep track of finances. At the end of the year, you’ll find your receipts, record the payments and get ready for tax season. These records help you file your taxes correctly the first time. Receipts also give you a record if you need to double-check rent payments. You can’t prove anything happened if you accepted cash without recording the transaction, but receipts offer solid proof.

Receipts help tenants make a budget and track their expenses. If you itemize the receipt, they’ll see exactly where their money is going. Your tenants use this information to plan a budget for the next month. For installment plans, they see how much they owe and pay you according to schedule. They’ll also have a record that they can review if they question a charge. A hard copy could prevent a lawsuit.

When do I send a rent receipt?

When do I send a rent receipt?

Send a rental receipt shortly after the tenant makes their payment. If they pay online, send the receipt through text or email. Otherwise, make a paper receipt and give it to them directly. Make a copy for yourself, so your tenant can request another copy if necessary. This could also prevent costly disputes.

Never write the rent receipt before you receive the payment. Otherwise, you’ll have inaccurate information in your records, like the wrong payment date or a different balance. Even a minor detail like the payment method becomes essential if the tenant questions the charge, so wait until the money arrives before confirming the transaction.

How much rent can I claim without receipts?

How much rent can I claim without receipts?

Make receipts every time you claim rent, no matter how little you charge. Even if you only charge $100 a month, lost records could lead to legal challenges, threatening your business’s future. Similarly, if your tenant pays in installments, make a receipt for everyone – even small payments like $50. This helps tenants track their payments and note their current balance.

Are rent receipts mandatory?

Are rent receipts mandatory?

Some states require landlords to give their tenants a receipt. Other states only require it if your tenant specifically requests the receipt to be part of your rental agreement. Look up the laws in your state to ensure that you meet the regulations. Otherwise, your tenant could file a complaint, resulting in fines and other penalties.

Even if your state doesn’t require receipts, make one for yourself every time you complete a transaction. You should also give your tenant a copy to confirm that you received their rent. If you don’t keep receipts, you’ll have no proof that a transaction took place in the case of a dispute or lawsuit. A tenant could claim they overpaid or gave you the same payment twice.