Must-not-miss write-offs as you wrap up 2022 year-end finances

Running a business is full of challenges, and small business owners need every edge they can get. Knowing the ropes when it comes to tax savings can help you stay confident and keep your business on track.

The following tax tips aim to help you find tax deductions and other crucial ways to save, while complying with all of your tax obligations.

Do I have to pay taxes on my business income?

Before digging deeper into small business tax preparation, it's important to do a quick refresher on the basics of income tax for small businesses.

In many cases, your business won’t actually pay taxes. Depending on your business structure, your company can be classified as a "pass-through entity," which means that the money literally passes through your business and directly to you, the owner.

This classification applies to those with the following types of business structures:

- Sole proprietorships

- Limited liability companies (LLCs)

- S corporations

Businesses with these structures will not pay taxes directly. Instead, the funds from the business are passed along to the business owner, who will record this in their income tax.

This also means that small business owners are required to pay a self-employment tax. The self-employment tax rate for 2022 is 15.3%, which includes 12.4% for Social Security and another 2.9% for Medicare taxes. Your self-employment taxes are designed to cover the costs that an employer customarily pays.

But even if you're responsible for paying the tax bill of your small business, it's wise to use a separate bank account for your business income and expenses. This ensures that you'll use this account only for business expenses, and your business and personal expenses will be separated to avoid confusion or financial liabilities.

This separation will simplify things when preparing your annual tax return and make it easier to obtain financing in the future.

1. Go over your financials from last year

One of the best ways to predict your current tax liability is to review the financial data from the previous year. Granted, you're still finishing up your fourth quarter, but you can compare your first three quarters' financials with the numbers from last year.

This comparison will give you a clearer picture of your taxable income, which will generally indicate whether this year's liability will be higher or lower than before.

This process assumes you're caught up on the business finances from the previous quarters. If not, now's the best time to catch up on your books. Having complete records will ensure that you close out the year with an accurate understanding of your business income and allow you to compare these numbers to the previous year.

Since most small business owners base their quarterly estimated tax payments on the income from the previous year, you can also take a moment to determine whether your estimated tax payments have been sufficient this year.

For example, if your business has grown compared to last year, you may owe an additional sum once you file your income tax return. Alternatively, if your expenses have grown, you could be entitled to a tax refund.

Don't forget to look at past expenses and deductions. If your deductible expenses have changed from last year to the present, you can likewise anticipate a larger tax burden for the current year.

2. Consider making year-end investments

If you've been thinking about upgrading your business or purchasing new equipment, now might be the best time. Making capital improvements at the end of the year can increase your deductible expenses and lower your overall tax bill.

For example, if you've decided to work from home for at least a portion of your week, you'll likely qualify for the home office deduction.

Tax deductible items include what helps you maintain the operation of your business. With the year coming to a close, your best bet is to invest in larger improvements, such as new office equipment, a remodeling project, or a major software upgrade.

Making a significant year-end investment is a strategic way to reduce your taxable income, which in turn reduces your tax liability for the year. And besides, the improvements you make aren't just tax deductions — they also enhance the effectiveness of your small business.

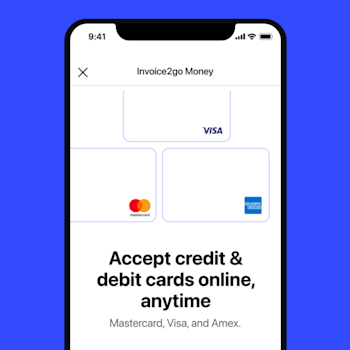

3. Write off your card processing fees

Every year, small business owners pay billions of dollars in credit card processing fees, which can take a small yet measurable bite out of your profits. However, the IRS allows business owners to deduct these fees as a business expense on their income taxes. This makes it easy for small businesses to accept card payments, since the related fees can be deducted from their taxes.

In fact, the IRS allows business owners to deduct any fees associated with the use of credit cards. This extends to processing payments from customers, as well as any fees that you incur from using a business credit card. However, it’s crucial to note that only business expenses qualify for a deduction, so business owners will need to be cautious and show validation (like a receipt) when claiming these expenses.

The right financial software platform can help you track and monitor these fees, which will help you validate these fees when making deductions on your annual income taxes.

4. Check on your retirement plan

If you're a solo entrepreneur, you can reduce your taxable income by contributing more to your retirement accounts. How much can you contribute? For 2022, the limits are as follows:

- 401(k) account: $20,500

- IRA (traditional or Roth): $6,000 (or $7,000 if you're 50 or older)

But as a small business owner, you can access other retirement options. For example, Simplified Employee Pension Plan (SEP) programs give you a significantly higher limit than the traditional examples above.

SEP programs allow you to set aside up to 25% of your income, to a max of $54,000 each year. Some financial providers offer a Defined Benefit Plan that can be ideal for those who want to put away large sums of money.

If you have employees, you can contribute to their retirement plans, which will lower the amount of employee wages subject to the Federal Unemployment Tax Act (FUTA). Making year-end adjustments to these contributions can therefore help you save money on payroll taxes.

5. Go over your inventory and check for uncollectible debts

Did you know that you can take a tax deduction for unsold inventory? This applies specifically to old or obsolete inventory you can no longer sell. The IRS allows you to make a tax deduction equal to the amount you originally paid for the inventory. The good news is that you likely already have this documentation as part of your procurement process.

You can also take a deduction for uncollectible debts. The IRS allows you to deduct "bad debt," which generally refers to money you may have included in your income but never actually received from the customer. Note, in order to take this deduction, you may need to demonstrate good-faith attempts to recover the debt from the delinquent customer.

Deducting these business expenses can lower your taxable income, which can help you save on your final income tax bill. You can also use your tax software program to calculate bonus depreciation of any fixed assets you own. This depreciation can lower the taxable business income you'll be responsible for during tax season.

6. Make sure to account for your charitable donations

Many customers already prefer purchasing from small businesses that engage in charitable giving. But charitable donations also offer specific tax advantages. Have you donated to any charities this year? Be sure to note all your donations when doing your taxes. Companies can write off up to 25% of their taxable income.

7. See if there are opportunities to defer taxable income or accelerate expenses

One of the most overlooked year-end small business tax tips involves the timing of your income and expenses. For example, deferring income can reduce the total amount of net and gross income you have for the year. Granted, you'll still have to pay income tax on this money the following year.

Another option would be to accelerate your expenses. This means paying for a major business expense before the year's end. This will also lower your net income, reducing your tax liability for the year.

Keep in mind, however, that these strategies only sometimes result in saving money, since these transactions will impact your taxes for the following year. Consult with a tax professional to determine your best options for reducing your gross and net profits before the year's end.

8. File the right end-of-year tax forms for small business owners

Small business owners who have employees must submit financial documents before the end of the year. This means that even though your company's tax forms won't be due until mid-April, your employees must receive tax documentation within the first month or so of the new year. Failure to distribute these forms can result in financial penalties.

Here are some of the most common tax forms.

Form W-2

Form W-2 is used to report the wages you pay to your employees. It also reports the taxes your business has withheld from those wages. You'll need to file this form with the U.S. Social Security Administration (SSA), and your employees must receive their W-2 no later than January 31. Your workers will use the data from this form when completing their personal income tax returns.

Form 1096

Form 1096 is functionally the same as a W-2, though this form is used exclusively for contract workers. Independent contractors who receive 1099s will need to receive Form 1096. In 2023, Form 1096 must be filed by February 28.

Form 941

Form 941 accounts for things such as Medicare tax, income tax, and any small business taxes that went toward the Social Security program. You must file this form quarterly, and the fourth-quarter due date is January 31.

Form 940

This form is used for the Federal Unemployment Tax (FUTA), which refers to payroll taxes paid for unemployment compensation for your employees. Form 940 must be filed by January 31.

Form 1095c

Small businesses that provide health insurance to their employees will need to file Form 1095c. These documents explain which employees receive coverage, and you can use them to determine who is eligible for tax credits. If this applies to your business, you'll need to provide Form 1095c by March 2.

9. Connect with a small business tax professional to go over tax deduction opportunities

These small business end-of-year tax tips make a great starting point, but some business owners will need professional guidance to comply with existing tax laws fully.

Consider working with a tax attorney or other professional to ensure that you comply with all reporting requirements and deadlines and get the greatest tax benefit you can for your business.

In fact, you should never file your income taxes without consulting with a tax professional or at least relying on some type of accounting software to check for errors. But the best reason to work with a tax expert is that they understand the U.S. tax code better than anyone. They may be able to find other tax-deductible expenses or credits that can improve your tax situation for the year.

For example, you may be able to take advantage of a tax credit this year. If you owe $10,000 yet have a $2,500 tax credit, you'll only have to pay a total of $7,500.

And if you're the owner of a pass-through business (e.g., a sole proprietorship, limited liability company, or S corporation), you can even use personal tax credits, including the child tax credit, when filing taxes for your business.

Good news if you're looking for small-business end-of-year tax tips

Before you file your tax return, consider investing in an innovative software platform that can improve the way you do business. Invoice2go provides cutting-edge solutions that help you send invoices, accept payments, and review your most important financial info.

With better access to your data, you'll be all the more equipped to reduce your tax payments and accelerate into the future. Sign up today to enjoy a 30-day free trial and discover how we can enhance your business.

The information provided on this page does not, and is not intended to constitute legal or financial advice and is for general informational purposes only. The content is provided “as-is”; no representations are made that the content is error free.

Related Articles

How to accept credit card payments on Invoice2go in 3 simple steps

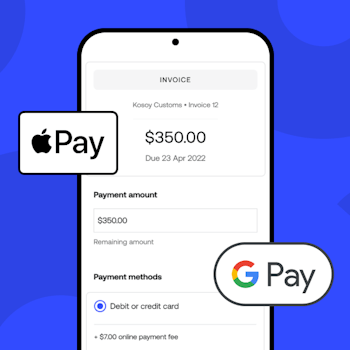

Accept payments online via Apple Pay and Google Pay

Must-not-miss write-offs as you wrap up 2022 year-end finances

5 ways accepting credit and debit card payments helps your business stay resilient

4 easy ways to increase cash flow today

What is Small Business Saturday and why is it important?

The features and surprising benefits of a well-designed packing slip