Your ultimate guide to effective invoicing

The most important part of any business is getting paid. But it can also be the most frustrating, especially when customers neglect to pay for your services or the invoice gets “lost in the mail.” Effective invoicing ensures that your clients pay their bills in a timely manner, and you maintain the cash flow you need for success.

In this article, we’ll cover the elements of an effective invoice and show you how you can upgrade your invoicing process.

What is an invoice?

An invoice is simply a request for payment. Typically, small business owners send invoices immediately after their products have been delivered or services have been rendered.

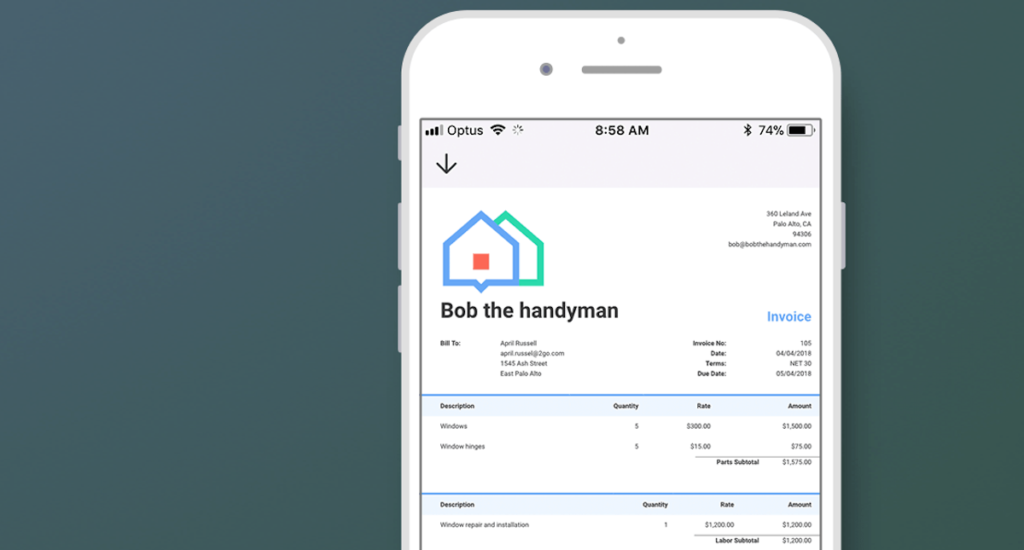

Invoices should contain the following relevant information:

- Your business name/company logo

- Your business contact information

- Client’s contact details

- A unique invoice number

- Date the document was prepared

- Description of goods/services rendered

- Grand total

- Payment options and terms

Your clients will not submit payment until they receive your invoice, and even then, they won’t always pay quickly. In fact, sometimes large companies will deliberately ignore your initial invoice, choosing to prioritize more immediate bills and expenses. If you want to maintain proper cash flow, you’ll have to create an effective invoicing system.

How to create an effective invoice

Effective invoicing doesn’t have to be complicated. Here are some tips to improve your billing system and stay up-to-date with all of your clients:

1. Establish a point of contact

When doing business with larger companies, it’s easier for your invoices to get lost in the shuffle. Simply invoicing the company directly won’t ensure that you receive the attention of your client’s billing and accounting department.

Before you even commit to a project, ask your client to designate a person who will receive and handle your incoming invoices. Establishing a clear point of contact will ensure that you’ll receive the attention of the right person, rather than having your bills lost in the stack of a manager’s desk.

2. Send invoices promptly

This advice may sound obvious, but the sooner you invoice clients, the sooner they can pay. Make it a point to send invoices immediately after the delivery of goods or the completion of your service.

It helps to talk to your clients ahead of time, so they know what to expect regarding your billing process. This approach ensures that they’re already anticipating the need to pay you within your desired timeframe.

Invoicing software and electronic invoice templates can help you create invoices quickly, so you’ll be better equipped to request payment from your customers.

3. Make sure your invoices are clear and easy to read

Your invoice format matters a great deal. Like most people, your client is likely to open the document and scan through it quickly. This scanning is why your invoices should be clear and simple to understand.

The label “Invoice” should be printed nicely near the top of your document. This header will alert the customer regarding the purpose of your communication and hopefully lead to them reaching for their wallet.

Make sure to use clear, precise language when discussing the details of your products and services. It’s okay to use part numbers, for example, but you’ll also want to record a brief description so your customers understand what they’re paying for.

For services, make sure to include the date that the service was performed as well as the number of hours or days it took to complete the project.

4. Offer multiple ways to pay

Sometimes flexibility is the surest path to efficiency. Your clients will appreciate having multiple payment methods to choose from and might be more willing to pay immediately if you offer their preferred payment option.

This preference is why having the right software is key, as these digital tools will allow you to accept credit cards, debit cards, and other payment methods that can contribute to more efficient invoicing.

5. Set a clear payment deadline

Effective invoicing also means setting clear payment terms. You’ll want to establish a clear deadline for when you expect to get paid.

You’re not required to set a due date, but doing so can ensure that your invoices receive speedy attention from your customers and encourage them to submit payments on time. Just make sure to communicate these expectations upfront. Otherwise, your customer may feel blindsided by these unforeseen expectations.

6. Charge penalties for late payments

Outstanding and overdue invoices can spell trouble for your company, as they prevent you from having access to the cash you need to maintain and grow your business. One of the ways you can encourage customers to pay promptly is to penalize late payments.

Due dates can vary, but it’s generally best to request payment within 30 days of the invoice. If your client fails to submit payment by this due date, you can charge them an additional 10% to 15%. If the client still doesn’t pay, charge them an additional fee. In other cases, you can specify “due upon receipt” and assess penalties if the invoice isn’t paid within 30 days.

As mentioned above, it’s important to be upfront about these expectations. Otherwise, your customer might be taken by surprise. But assessing late fees can nudge your customers to respond promptly.

Alternatively, you can also incentivize early payments. For example, you might offer a 10% discount to customers who settle their bills within seven days. Sure, this takes a small bite out of your sales, but you may discover it’s better to have access to these funds as soon as possible and spend less time chasing down outstanding invoices.

7. Keep detailed records

In addition to your billing and sales records, you should also be maintaining accurate records of all of the work you perform. In fact, keeping good records will assist in the invoice creation process, as you’ll be better equipped to report data such as items sold, services performed, and the number of hours you worked.

Basically, anything that you can bill for should be written down. This way, there can never be a question as to the validity of the contents of your invoices.

Depending on your industry, you may also be accustomed to using purchase orders. Purchase orders are sent to you by your client and include a detailed list of the items or services they wish to purchase. Your final invoice should reflect the contents of this purchase order, and you can even match your invoice numbers and purchase order numbers to eliminate confusion.

In other words, good record keeping will save you from questions about the content of your invoices or the final totals.

8. Stick to your guns

You may face situations where customers ask for leniency or some exception to things like late fees. But it’s important to be consistent in the way you apply your policies.

For starters, you owe it to yourself to get paid promptly and fairly. Your time is valuable, and your customers should respect your skillset. According to recent research, nearly one in three (29%) small businesses fail because they run out of cash. Your business success depends on your ability to receive payment for your sales and services.

Additionally, if you make an exception for one customer, you run the risk of your other clients finding out. This knowledge can create friction in your customer relationships and potentially damage your public reputation.

9. Use space effectively

Once you complete your invoice, take a look at the layout. Do you see a lot of blank space? If so, you might consider how to use this space to your advantage. While you don’t want to clutter up your document with a lot of unnecessary details, you could add some other information that can help your business.

Small businesses can include details such as:

- Information about upcoming promotions

- A note about related products or services

- An advertisement about a seasonal package or event

Basically, you can use this additional space to encourage repeat business and increase customer loyalty.

10. Add a personal thank-you

Effective invoices should also include a human touch. Add a brief note to thank your customers. Even if it’s a bit boilerplate, this can go a long way to improving client relationships and may even encourage your clients to come back to you for future business instead of going to one of your competitors.

Advantages of using invoicing software

You’ve probably noticed that many of our invoicing tips involve the use of software in some capacity. In an age where so many business transactions take place online, it makes sense to rely on state-of-the-art invoicing tools to streamline your billing process.

Here are a few of the ways that your business can take advantage of online software:

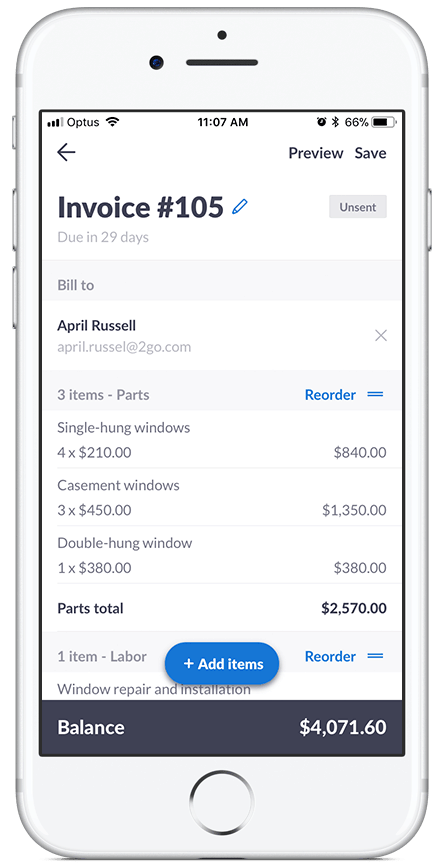

Create and send professional invoices

Invoicing software will allow you to create and send professional invoices to all of your clients. You can customize an invoice template to match your brand and send the final document electronically to your clients. This approach will keep you looking professional, as well as help you send invoices promptly.

Accept credit card payments

Sending invoices electronically also allows your customers to submit payments electronically. Many software platforms allow you to accept payments in the form of credit cards, debit cards, or online payments including PayPal and Zelle.

Send automated reminders

When you use a software platform, you’ll have the ability to send automated payment reminders to each of your customers. This automation helps eliminate the need for you to track down outstanding invoices and also ensures that you get paid quicker.

Set up recurring invoices

One of the best ways to increase efficiency is to set up recurring invoices. This method is ideal for those who provide a regular, repeat service such as web design, landscaping, or freelance writing.

You can send recurring invoices to your clients and set a regular due date, often weekly or monthly. The advantage is that if your client slips up and fails to send the money they owe, you have the option of addressing the issue and resuming business.

This billing method also saves you from having to generate a new invoice for the same service, which can likewise streamline your operations.

Streamline your billing process

Invoicing software just makes your life easier. These digital tools provide reliability and automation that can relieve you of some of your administrative burdens. As a small business owner, this freedom means that you can spend less time worrying about your billing system and spend more time focused on growing your business.

Keep track of cash flow

The right software can help you keep track of your finances and even generate reports to help you stay on top of your financial health. This analysis is essential for proper bookkeeping procedures, but it can also help you evaluate how your business is performing.

The reporting features integrated into today’s financial software can therefore help you hone your strategy and make decisions about the future of your company. In other words, invoicing software isn’t just a matter of convenience; it can be an essential tool to propel you forward.

Things to consider when evaluating invoicing software

Before you invest in a software package, consider all of the features and details that it offers. Compare things like:

- Core features

- Automated processes

- The availability of a mobile app

- Transaction fees

- Monthly fee

At the same time, don’t forget that by paying for the right software, you can dramatically improve your efficiency. That provides a greater opportunity for your business to grow, which truly makes this type of software a critical investment in your company.

Change the way you invoice

Make every transaction count by using Invoice2go’s innovative invoicing platform. Our software helps you design customized invoices and send them to your clients in mere seconds. Plus, you’ll receive your money faster by using our automated payment reminders and multiple payment options.

Related Articles

How to accept credit card payments on Invoice2go in 3 simple steps

Accept payments online via Apple Pay and Google Pay

Must-not-miss write-offs as you wrap up 2022 year-end finances

5 ways accepting credit and debit card payments helps your business stay resilient

4 easy ways to increase cash flow today

What is Small Business Saturday and why is it important?

The features and surprising benefits of a well-designed packing slip