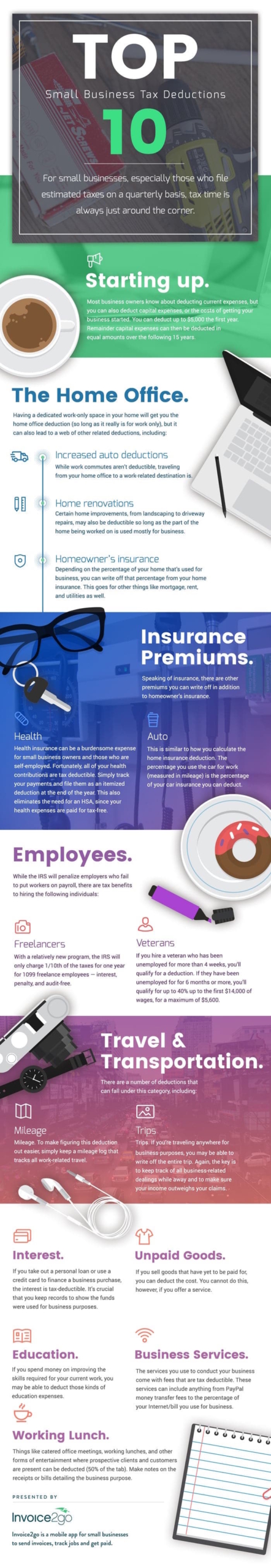

Top 10 US small business tax deduction tips

Small business owners are often running full speed ahead in managing their business and pursuing their dreams, while tax and cost saving are not at the top of their minds. However, when it comes to income tax, every dollar counts. With many common and often forgotten income tax deductions to consider, here are the Top 10 Income Tax Deduction Tips for small businesses who file estimated taxes on a quarterly basis.

Always remember to document everything to become an expert record-keeper and it’s important to note that these income tax deductions apply to small business owners in the U.S.

1. STARTING UP

Most business owners know about deducting current expenses, but you can also deduct capital expenses, or the costs of getting your business started. You can deduct up to $5,000 the first year. Remainder capital expenses can then be deducted in equal amounts over the following 15 years.

2. THE HOME OFFICE

Having a dedicated work-only space in your home will get you the home office deduction (so long as it really is for work only), but it can also lead to a web of other related deductions, including increased auto deductions, home renovations and homeowner’s insurance

3. INSURANCE PREMIUMS

In addition to the benefit from homeowner’s insurance, you can write off Health and Auto insurance premium as well.

4. EMPLOYEES

While the IRS will penalize employers who fail to put workers on payroll, there are tax benefits to hiring Freelancers or Veterans.

5. TRAVEL & TRANSPORTATION

Mileage and Trips fall under this category and are eligible for deduction – perfect for those businesses on the road.

6. INTEREST

If you take out a personal loan or use a credit card to finance a business purchase, the interest is tax-deductible. It’s crucial that you keep records to show the funds were used for business purposes.

7. BUSINESS SERVICES

The services you use to conduct your business come with fees that are tax deductible. These services can include anything from credit card and PayPal money transfer fees to the percentage of your Internet/bill you use for business.

8. WORKING LUNCH, ETC.

Things like lunch meetings, working lunches, and other forms of entertainment where prospective clients and customers are present can be deducted (50% of the tab). Make notes on the receipts or bills detailing the business purpose.

9. UNPAID GOODS

If you sell goods that have yet to be paid for, you can deduct the cost. Apps such as Invoice2go, a Bill.com company, help you to keep track of outstanding invoices and when do you actually get paid from customers – it can be a handy tool before busy tax time.

10. CONTINUED EDUCATION

For those who spend money on improving the skills required for your current work.

If you’re wondering what tax deductions you might be missing out on, read our post on Top 15 Small Business Tax Deductions before you file quarterly tax every time. For other great tax time tips, check out Tackling Tax Time with Invoice2go and Deducting Credit Card Fees at Tax Time.

Related Articles

How to accept credit card payments on Invoice2go in 3 simple steps

Accept payments online via Apple Pay and Google Pay

Must-not-miss write-offs as you wrap up 2022 year-end finances

5 ways accepting credit and debit card payments helps your business stay resilient

4 easy ways to increase cash flow today

What is Small Business Saturday and why is it important?

The features and surprising benefits of a well-designed packing slip